National Unified USSD Platform (NUUP)

National Unified USSD Platform (NUUP) - *99*49#

Service Overview

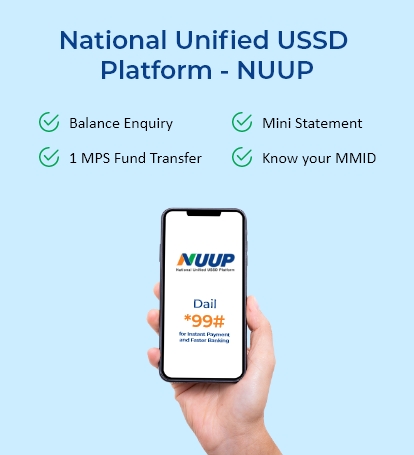

*99# - National Unified USSD Platform (NUUP)

*99# - National Unified USSD Platform (NUUP) is a platform provided by NPCI (National Payment Corporation of India) which works on the USSD technology, which is a transmission protocol used by GSM cellular telephones to communicate with the Telecom Service Providers (TSP). Though similar to SMS (Short Messaging Service), the USSD message however creates a real-time connection which remains open, thereby allowing a two-way exchange of data.

The service is available on simply dialing the short code *99# from any basic mobile phone, irrespective of the telecom service provider or mobile handset capability and without any need for a mobile internet plan.

Benefits of USSD (NUUP) service

- An interactive session oriented service

- Simple and easy to use

- Works on almost all GSM handsets

- GPRS connection (Internet data plan) not required

- Works even while on the move

- More secure than SMS

- Interoperable with UPI

Services currently available

Financial :

Send Money to

- Mobile Number (Applicable only if mobile number is registered on BHIM App/NUUP Channel)

- Aadhar Number

- Virtual Payment Address (VPA)

- IFSC and Account Number

- Saved Beneficiary

Request Money to

- Mobile Number (Registered on BHIM App /NUUP Channel)

- Virtual Payment Address (VPA)

Non-Financial :

- Add / Change Bank Account

- Check Balance

- Set / Change UPI Pin

- View last 5 Transactions on UPI

- View / Update Profile

FAQs

USSD (NUUP) Banking (FAQs)

- Dial *99*49# (IDBI Bank direct code for first time users to select account) or dial *99# and enter Bank Name (IDBI) or 2 digit numeric code (49), or 3 digit bank short code (IDB) or 4 digits of IFSC (IBKL).

- Select desired language

- Choose an account from the list of bank accounts linked to your mobile no. with the bank.

- Enter last 6 digits of your debit card and expiry date separated bysingle space

- Enter and re-enter 6 digit UPI PIN.

- Your UPI PIN is set and Virtual Payment Address is automatically created.

* Please ensure your latest mobile number is updated to single unique Customer ID. If your mobile number is linked to multiple Customer ID's, you will be denied access to the service.

- Dial *99#

- Select option ‘UPI PIN’

- Enter last 6 digits of your debit card and expiry date separated by single space

- Enter and re-enter 6 digit UPI PIN.

- Confirmation message of successful UPI PIN generation is displayed on the mobile screen

- Dial *99#

- Select option for Sending money using Mobile Number (Registered on BHIM App or NUUP channel) / Aadhaar Number / VPA – Virtual Payment Address / IFSC & Account No. / Saved Beneficiary.

- Enter details as per beneficiary details chosen above.

- Enter UPI PIN.

- Check Transaction status (Successful/Failed) displayed on your screen.

- Dial *99#

- Select option for Request Money

- Enter Remitter’s Mobile Number (Registered on BHIM App / NUUP Channel) or VPA to collect money

- Collect request is sent to the recipient on their respective UPI app or via SMS

- You will receive money once remitter has authorized the request.

Dial *99#, select option for checking Balance and enter UPI PIN to get the balance details on your mobile screen.

Dial *99#, select option ‘Pending Requests’ and accept the request by entering UPI PIN. You will receive a successful/failed payment message on your mobile screen.

Dial *99#, select option ‘My Profile’ and choose option to change Bank Account. Enter Bank code (as explained in Q1) to get the list of accounts linked and select account to be set as primary account. If UPI PIN is not set for the account selected, OTP is triggered to the user for setting UPI PIN.

Dial *99#, select option ‘My Profile’ and choose ‘My Details’ to see details such as Name, Virtual Payment Address, Bank Account Linked and UPI PIN status.

- Dial *99#

- Choose option ‘UPI PIN’ and select ‘Reset UPI PIN’

- Enter Debit card credentials and OTP received from the Bank

- Enter and Re-enter UPI PIN.

- Confirmation message of successful UPI PIN generation is displayed on the mobile screen.

- Dial *99#

- Choose option ‘UPI PIN’ and select ‘Change UPI PIN’

- Enter old and new UPI PIN.

- Confirmation message of successful UPI PIN change is displayed on the mobile screen.

Dial *99#, choose option Transactions to get your last few UPI/NUUP transactions.

Dial *99#, choose option My Profile and select Manage Beneficiary to add/view/delete beneficiary.

Only one transaction is allowed per session. Dial *99# to initiate a fresh transaction.

Dial *99#, select option ‘My Profile’ and choose option to change the language. Select desired language from the list and confirm.

NUUP is currently available on 11 Multi-lingual languages.

| Hindi | Tamil | Telugu | Malayalam | Kannada | Gujarati |

| Oriya | Bengali | English |

NUUP service does not require any mobile internet connection or software to be downloaded on the mobile. It works even on the most basic GSM mobile handsets

There is no need to have GPRS or any such data connection on your mobile. You can use the service from any GSM mobile which has a voice calling capability.

No. USSD channel is supported only on GSM mobiles.

Yes, You need UPI PIN to check balance and for any type of financial transactions. UPI PIN is not required for checking your profile and last few transactions.

No, Just dial *99# to link your Bank account and register yourself for NUUP service. You need not be registered for IDBI Bank Mobile Banking channel.

Transactions through NUUP Channel can be sent and received 24 hours all days in a year including holidays.

Yes. TSPs charge the customer for using *99# service. Please contact your Telecom Service Provider to know the exact charges for using the service. However, TRAI (Telecom Regulatory Authority of India) has set a maximum ceiling of Rs. 0.50 per transaction for using this service.

No, it will not be possible to stop or cancel financial transaction after it has been initiated.

Maximum per day transaction limit for NUUP (USSD channel) is Rs.5,000/- (five thousand Only) as is also applicable to SMS based funds transfers (as per RBI guidelines).

For any financial transaction, you have to initiate and authorize each and every payment made from your account using your UPI PIN. Please do NOT share your UPI PIN/ Debit Card credentials/OTP with anyone and do not save it on your mobile handset in any manner.

UPI PIN for IDBI Bank Accounts is a six digit Numeric PIN (e.g. 123456).

Virtual Payment Address" is a unique identifier or Alias(for example ‘myname@idbi’) that is mapped to an account. VPA acts as a payment identifier for sending and collecting money between any two parties without knowing the recipient’s name, bank account number and IFSC code.

In case you face errors like 'Invalid Command' or 'Try again', please check if your mobile operator is in the NUUP list of NPCI. If yes, then the error may be due to a network issue in your area. You may try initiating the transaction after sometime. In case the issue persists, please check with your mobile operator.

- Accounts that are operated by Single/Self, “Either or Survivor”,“Anyone or Survivor” or by Proprietor, Karta (HUF) and are allowed to access NUUP/ UPI services. Accounts operated by any other mode such as jointly, former or survivor, latter or Survivor etc. are currently restricted.

- Accounts of ‘Minors’ are currently restricted from availing this service. Account Holder should be ‘Major by Law’.

- Accounts belonging to certain schemes such as accounts maintained and operated by customer who is NRI and Accounts maintained in foreign currencies are restricted.

- Accounts that are inactive or dormant are restricted.

- Accounts maintained by Individuals, Proprietor or HUF are allowed. Any other Non-Individual Entity type such as Partnership Firms, Corporates are currently restricted from NUUP / UPI services.